Digital assistants based on AI, machine learning and natural language processing are transforming various industries by streamlining complex processes and offering customised user experiences. They are characterised by the fact that they learn and adapt to user preferences. They are proving particularly valuable in finance for data analysis and decision making, and in manufacturing for operational efficiency and predictive maintenance. This move towards digital assistants is a major step towards automation and smart technology in the corporate world. It is not just a technological upgrade, but a fundamental shift in business processes and customer interaction that paves the way for a connected and efficient future in industry and finance.

Inhaltsverzeichnis

What is a digital assistant?

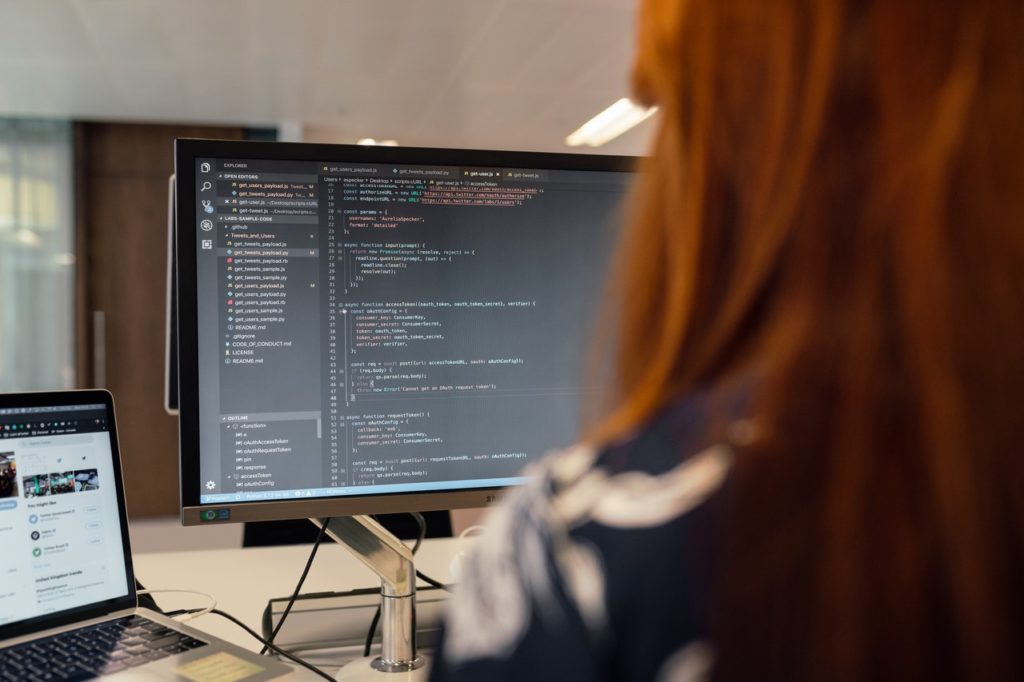

A digital assistant is a highly sophisticated Software programme that artificial intelligencemachine learning and natural language processingto perform tasks and interact with users. AI is the core technology that enables digital assistants to intelligently process and respond to user requests. This includes understanding the context and nuances of human language, which is made possible by NLP so that these assistants can understand and conduct a human-like conversation.

The inclusion of the machine learning is crucial for digital assistants to become more effective over time. Using machine learning, these tools analyse data from previous interactions to learn users' behaviour, preferences and patterns. This Ability to learn enables digital assistants to increasingly personalised experiences to offer. In a business environment, for example, a digital assistant could learn an executive's preferences for meetings or a financial professional's frequent data requests and anticipate and adapt to these needs in future interactions.

Digital assistants are designed to streamline complex processes and make interactions more efficient and user-friendly. Their ability to adapt to users' individual needs and preferences, combined with the sophistication of their underlying technologies, makes them valuable tools in various sectors, including finance and manufacturing. In these industries, digital assistants are significantly improving operational efficiency, decision-making processes and customer service, reflecting a general trend towards automation and smart technology in the business world.

Our article shows how machine learning is fundamentally changing the way we work, from telecommunications to the manufacturing industry:

Differences between digital assistants and chatbots

Digital assistants and Chatbots are often used synonymously, but differ considerably in their capabilities and complexity.

Chatbots are computer programmes that are used for certain, rule-based tasks such as answering frequently asked questions or carrying out simple transactions. They function mainly via predefined scripts and are only able to process complex or unexpected requests to a limited extent.

Digital assistants In contrast, digital assistants are advanced forms of chatbots that are equipped with artificial intelligence, machine learning and natural language processing. Thanks to this technological foundation, digital assistants are able to understand a wide range of requests and respond to them with a higher degree of complexity and personalisation to answer questions. Unlike simple chatbots, digital assistants can learn from user interactions and customise their responses and suggestions based on individual user preferences and history.

The The main difference lies in their functional depth and flexibility. While all digital assistants are essentially chatbots with advanced features, not all chatbots are digital assistants. Digital assistants are able to multi-task, understand context and offer personalised and more sophisticated interactions that go beyond the simple, task-oriented functions of standard chatbots. This makes them better suited for complex applications in various industries, such as finance and manufacturing, where they can perform a wider range of functions with greater adaptability and intelligence.

You can find more exciting information about chatbots and where you can use them in your company in our blog:

Popular digital assistants

Digital assistants that are supported by advanced AI are a essential part of our interaction with technology have become. They are integrated into a range of platforms, from smartphones to smart home devices, and are changing the way we access information and manage our daily activities. Here are some of the most popular, each offering different features and functions to fulfil different user needs in different areas.

- SiriSiri was developed by Apple Inc. and is a voice-controlled personal assistant on iOS devices. It can answer questions, make recommendations and perform actions by forwarding requests to a range of internet services. Siri's applications range from setting reminders and sending messages to navigation assistance and news updates, making it a versatile assistant for everyday tasks.

- AlexaAlexa was developed by Amazon and is a voice service that controls Amazon Echo and other devices. It can play music and provide information, news, sports scores, weather and much more. Alexa's skills are extensible, allowing integration with smart home devices and making it popular in home automation and entertainment.

- Google AssistantGoogle's AI-powered assistant supports both voice and text input and is available on mobile and smart home devices. Its functions include voice search, managing appointments and controlling smart devices. Google Assistant is characterised by its ability to understand the context of a conversation, making it a powerful tool for information search and daily task management.

- CortanaCortana was developed by Microsoft, is integrated into Windows 10 and supports both voice and text commands. It helps with appointment scheduling, reminders and answering questions via Bing search. Cortana is also integrated into Microsoft's productivity software and helps manage business and personal tasks.

- BixbySamsung's digital assistant, Bixby, is designed to help with device tasks, searching for information and controlling the smart home. Unique in its deep integration with Samsung devices, Bixby supports device-specific commands and can perform tasks such as screen settings and app navigation.

These digital assistants demonstrate the evolving capabilities of AI in various areas, from personal task management to smart home control and business operations, and show the growing range of digital assistance in everyday life.

How does a digital assistant work?

The functioning of a digital assistant revolves around three core technologies: natural language processing (NLP), natural language understanding (Natural Language Understanding, NLU) and machine learning (ML).

NLP enables the digital assistant, process and interpret human languagewhether spoken or written. This processing includes parsing sentences, recognising speech patterns and understanding the nuances of different languages. The natural language understanding component goes one step further by recognising the intent behind a user's words. This capability enables digital assistants to understand complex commands or requests that go beyond mere word recognition.

Machine learning is an essential part of developing the performance of a digital assistant. With each new interaction, these assistants learn and adapt their responses based on user behaviour and preferences. This learning aspect enables a digital assistant to, personalised experiences to offer. For example, if a user frequently asks for certain types of financial reports, the assistant learns to anticipate this information and prioritise it for future interactions.

Digital assistants also integrate Data from various sourcesto improve their functionality. They connect to external Databasesinternal systems and online resources and summarise this information to provide comprehensive, contextualised answers. In combination with artificial intelligence, this integration enables digital assistants to provide differentiated and relevant support that is tailored to the needs and preferences of individual users, offering a highly personalised interaction experience.

The natural, spoken language of humans is the most direct and easiest way to communicate. Learn how machines and algorithms use NLP in innovative ways:

Natural Language Processing (NLP): Natural language for machines

Applications in industry and finance

Digital assistants are increasingly being used in business areas, particularly in finance and manufacturing, to increase efficiency and optimise processes. Here are five examples of how they are changing these industries:

- Supply chain management in manufacturingDigital assistants contribute to efficient supply chain management in manufacturing. They track stock levels, forecast delivery requirements and can even automate the ordering of raw materials, thereby optimising the supply chain process.

- Predictive maintenanceDigital assistants analyse data from manufacturing equipment to predict when maintenance is required, reducing downtime and increasing productivity. This forward-looking approach is essential for maintaining the high efficiency of production lines. essential.

- Automated customer service in financeIn the financial sector, digital assistants are used for customer service, handling enquiries about account balances, recent transactions and investment advice. This improves the customer experience by providing immediate answers and reduces the workload of employees.

- Risk assessment and managementDigital assistants support financial analysts in risk assessment by quickly processing large amounts of data to identify potential risks and opportunities. This use of AI-driven analyses helps to make informed decisions, especially for investments and credit approvals.

- Employee training and supportIn the finance and manufacturing sectors, digital assistants are used to train new employees by giving them instant access to information and procedures. They also support existing staff by answering procedural questions quickly, increasing overall efficiency in the workplace.

Digital assistants in organisations are not just tools for automation, but are becoming integral components that contribute to strategic decision-making, operational efficiency and customer satisfaction. Their role in finance and manufacturing illustrates the broader potential of AI in transforming business practices.

Find out how predictive maintenance is changing Industry 4.0 in five innovative use cases.

Predictive Maintenance Use Cases - Five Examples from Practice

Challenges during implementation

The implementation of digital assistants in an organisation brings with it a number of challenges. These challenges can have an impact on the effectiveness and efficiency of the integration of digital assistants.

- Cost-benefit analysisOne of the biggest challenges is weighing up the costs against the benefits. The introduction of digital assistants requires a significant investment in technology and training. Companies need to assess whether the potential efficiency gains and improvements in customer service justify this investment.

- Integration into existing systemsSeamless integration into existing business systems is crucial. Digital assistants need to work with existing software and databases. This integration can be complex, especially in organisations with outdated or legacy systems.

- Data protection and securityAs digital assistants handle sensitive data, especially in sectors such as finance, ensuring data privacy and security is of paramount importance. Organisations need to implement robust security measures to protect against data breaches, which can be a challenging and ongoing task.

- User acceptance and trainingAnother challenge is to ensure employee acceptance. Employees need to be trained to use these systems effectively and there can be resistance to the introduction of new technologies. To overcome this, clear communication about the benefits and comprehensive training are required.

- Maintaining accuracy and relevanceIt is a constant challenge to keep the information provided by digital assistants correct and up-to-date. This requires regular updates and maintenance, which can be resource-intensive.

- Scalability and flexibilityAs organisations grow and evolve, their digital assistants need to scale and adapt. It can be a challenge to ensure that these systems are scalable and flexible enough to meet changing business needs.

Overcoming these challenges requires careful planning, a clear understanding of business requirements and a commitment to the ongoing maintenance and improvement of digital assistance systems.

Future prospects for the digitalisation of work processes

Digital assistants have had a significant impact on the business landscape, particularly in the finance and manufacturing sectors. They have revolutionised customer service, data processing, supply chain management and predictive maintenance, improving efficiency and decision making. The integration of these AI-driven tools has streamlined complex processes, enabling personalised customer interactions and more efficient workflows.

Looking to the future, potential advances in digital assistant technology will continue to impact business operations. With the advancement of AI and machine learning technologies, digital assistants are expected to become more sophisticated and offer even higher levels of personalisation and predictive capabilities. This development is likely to lead to more intuitive interactions, deeper integration into business processes and an expanded range of applications in different industries.

Digital assistants are not just a current tool, they represent a strategic investment in the future of business operations and promise a landscape where efficiency, personalisation and intelligent decision making are the norm.

0 Kommentare