AI Agents for Fraud Detection

Tackling Fraud in Banking: Challenges, Trends and Solutions

- Published:

- Author: Dr. Nicholas Drude, Dr. Till Plumbaum

- Category: Deep Dive

Table of Contents

In the banking sector, financial losses caused by fraud have risen sharply in recent years — in Germany alone, they amount to tens of billions of euros annually. Professional criminals are increasingly exploiting digital channels and using ever more sophisticated attack strategies, while banks struggle to mount an effective defense with existing systems.

At the same time, regulatory pressure is growing — driven by frameworks such as the EU Payment Services Directive (PSD2), the Anti-Money Laundering Directive (AMLD), and the EU Artificial Intelligence Act (AI Act). Considering these challenges, holistic and high-performing fraud management is becoming a top priority.

In the following, you’ll find an overview of the most common types of fraud in banking, current detection methods, key vulnerabilities, and recent technological developments — from both the attacker’s and the defender’s perspective. We also explore emerging requirements for modern fraud detection tools.

Fraud Detection in Banking: A Growing Complexity

Fraud strategies range from identity theft when opening accounts, phishing and vishing (voice phishing) to complex money laundering methods and are increasingly using new technologies, such as deepfake videos, to disguise and intensify their activities. Many conventional fraud detection systems are rule-based and react to known anomalies, such as unusual transaction amounts or login attempts from unknown regions. However, such approaches are increasingly reaching their limits: they are easy to circumvent, often sound the alarm even though everything is in order and usually fail to recognize new types of fraud in good time.

Against this backdrop, the key challenge for banks is to transform existing systems and approaches into an integrated, holistic solution. The previously fragmented data streams from different channels - such as online banking, lending or branch business - must be brought together in a consolidated, cross-channel platform. Only this integration will enable consistent real-time scoring that reliably recognizes even complex fraud patterns. In addition, such a central platform for data aggregation and analysis is crucial for detecting serious anomalies at an early stage and ensuring the necessary data quality that machine learning models require making precise, complete and reliable predictions. This creates a comprehensive, context-related view of customer activities across all touchpoints - the essential basis for adaptive and sustainable fraud prevention.

Existing Vulnerabilities and Risks

Despite progress in the integration of data and systems, significant security gaps remain in the banking sector.

Fraudsters are becoming increasingly agile in their response to technical innovations and specifically exploit remaining vulnerabilities, for example in process flows or newly introduced technologies. Especially when implementing new, complex fraud detection models, there is a risk that these cannot be adapted quickly enough to changing attack patterns.

Another risk is that banks may rely too heavily on purely technical solutions and neglect the necessary interaction between AI-supported models and human expertise. Complex or novel fraud scenarios in particular still require human judgment to correctly calibrate algorithms, critically evaluate results, and ultimately ensure sustainable and reliable fraud prevention.

AI Agents, Generative AI, XAI: Trends and Technological Developments

Modern fraud strategies are dynamic and use new technologies, which pushes conventional, rule-based systems to their limits. Agentic AI approaches are an advanced response to this challenge. Agentic AI refers to a new category of AI systems that not only react to problems but can also act autonomously. Unlike traditional AI models that follow fixed rules or require human input, agentic systems are goal-oriented “agents” that can perceive, reason and take action in real time. They can be thought of as digital detectives that monitor systems, detect anomalies and respond immediately to threats without waiting for human approval.

AI Agents make it possible to respond to the new challenges by combining proven rules with self-learning algorithms, and are therefore able to identify anomalies at an early stage - even without explicit specifications. They can also be integrated into existing systems, such as big data platforms, and can therefore process large volumes of transaction and customer data efficiently and in real time.

By using graph technologies in combination with GenAI and agents, relationships and networks between actors can be analyzed dynamically - a decisive advantage when uncovering coordinated fraud networks. At the same time, explainable AI approaches create transparency about the decision-making logic of the models, which not only promotes trust but also fulfills regulatory requirements.

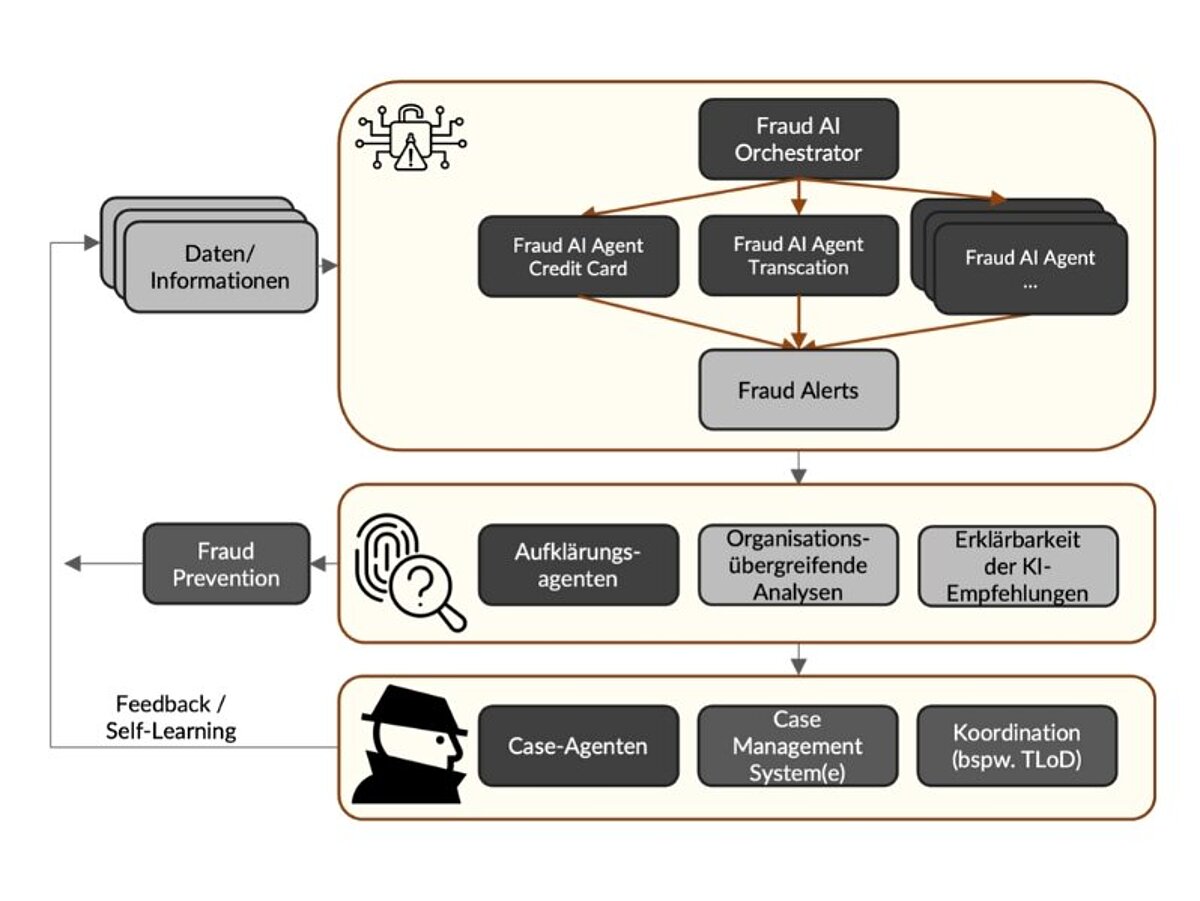

Figure 1 shows an Agent-based fraud platform. This consists of specialized AI agents that generate fraud alerts along defined product and typology matrices. In addition, reconnaissance agents analyse these alerts to minimize false alarms and make the basis for decision-making comprehensible, while case agents take over the structured documentation and case processing. The entire process is controlled by a central orchestrator, which ensures efficient collaboration between the agents and integration into existing case management and prevention systems. AI-based text processing models (large language models) are also increasingly being used in the know-your-customer (KYC) environment. They enable automated checking of external documents such as annual reports or online sources and detect anomalies and inconsistencies much faster than manual checking processes.

Practical Applications of Fraud Detection

Two projects by [at] show how such technologies can be used in practice:

Fraud Prevention with Big Data for Banks

A digital bank is looking to sharpen its approach to fraud prevention and detection. Until now, however, there was no effective way to perform network analyses. In other words, to examine the relationships between customers, products, and transactions for suspicious patterns or correlations.

To address this, our [at] experts developed a big data architecture that logically connects a wide range of data sources and systems. This consolidated database enables efficient and reliable network analysis. It's powered by a pattern recognition algorithm that automatically detects unusual connections, transactions, or behaviors.

This solution helps the bank spot fraud early, or even stop it before it happens. But it doesn’t stop there: it also uncovers valuable insights into how products, customers, and transactions interact, even beyond fraud-related use cases. That opens up new opportunities to improve services and develop products more strategically.

Fraud Prevention with Advanced Analytics for Credit Allocation

A financial institution wants to reduce the manual workload involved in checking vehicle financing applications — without compromising fraud detection. Up to this point, salary verification for applicants was done manually and on a random basis — a time-consuming process with limited scalability.

To speed up this process and simultaneously improve fraud detection, our [at]-experts developed a machine learning model that calculates the fraud probability for each individual financing transaction. When suspicion arises, the case is automatically flagged for manual review.

The result: a 56% reduction in manual effort — with fraud detection rates remaining consistently high. The system also holds strong potential for future improvements, such as integrating additional data sources or refining the models through MLOps-driven optimization.

“The result: a 56% reduction in manual effort […]”

Requirements for Modern Fraud Detection Tools

As the use cases described show, the key to effective fraud detection lies in the intelligent, networked use of relevant data. This ranges from account opening and transaction behavior to external risk information. Only if this information is bundled centrally and evaluated in real time can risks be identified at an early stage and well-founded decisions made.

It is important that suspicious activities are recognized immediately and only cases that are relevant are forwarded for review. This not only reduces manual effort, but also protects against alarm fatigue in the specialist departments.

However, the models must also be continuously adapted to new fraud patterns - ideally through the use of MLOps workflows that ensure automated model monitoring, updating (retraining and fine-tuning) and deployment. At the same time, transparency and traceability are essential for meeting regulatory standards and building user trust. Explainable AI (XAI) plays a key role by making the model's decision-making processes understandable. To fulfill these demands, Agentic AI systems are required. These systems go beyond static rules and can detect anomalies independently and respond appropriately. Their autonomous Agents can continuously monitor data streams, make real-time decisions, and adapt dynamically to emerging threats.

In addition, modern fraud detection systems must be seamlessly adaptable to existing business processes and IT environments—whether in digital channels or physical branch infrastructures. Open interfaces, such as APIs or webhooks, are essential to ensure cross-system data availability and efficient information flow.

Finally, a scalable, high-performance architecture is critical—one that remains reliable even as data volumes grow and fraud tactics evolve. Ideally, this architecture should be cloud-based, containerized, and designed to support MLOps for continuous monitoring, updating, and optimization of detection models.

Conclusion

Those who consistently rely on integrated platforms, high-quality data, and advanced AI processes lay the foundation for sustainable and effective fraud detection. This not only helps reduce financial losses but also strengthens customer trust.

As a result, fraud detection evolves from a mere protective measure into a strategic driver of customer loyalty and long-term growth. The key lies in the smart integration of all relevant data sources, from transaction and device data to onboarding information. Only a holistic view of customer behavior enables banks to spot fraud patterns early and respond with precision.

Curious about where your organization stands in fraud detection and how modern AI-driven approaches could be applied in your business? Get in touch with us for a no-obligation consultation or a tailored use case assessment.

Share this post: