Artificial intelligence in the insurance industry

Data science and artificial intelligence are transforming insurance in all areas - from underwriting and fraud detection to marketing and customer service. Learn how Alexander Thamm can help you find an approach to drive the digitalisation and automation of your processes.

DATA & KI PROJECTS FOR INSURANCE COMPANIES

Hardly any other industry has such a wealth of data as insurance. In addition to customer and claims data, this also includes geographic, real estate and traffic data. However, this data is often unstructured and not digital. Text mining, big data analytics and artificial intelligence (AI) can now make this data usable and link it together.

The applications of AI in the insurance industry are huge and offer incredible potential. With our years of experience in the financial industry, we support you in identifying and selecting the right Use Cases, to get out of your

data to generate real added value. A successful path into a digital future requires a holistic system.

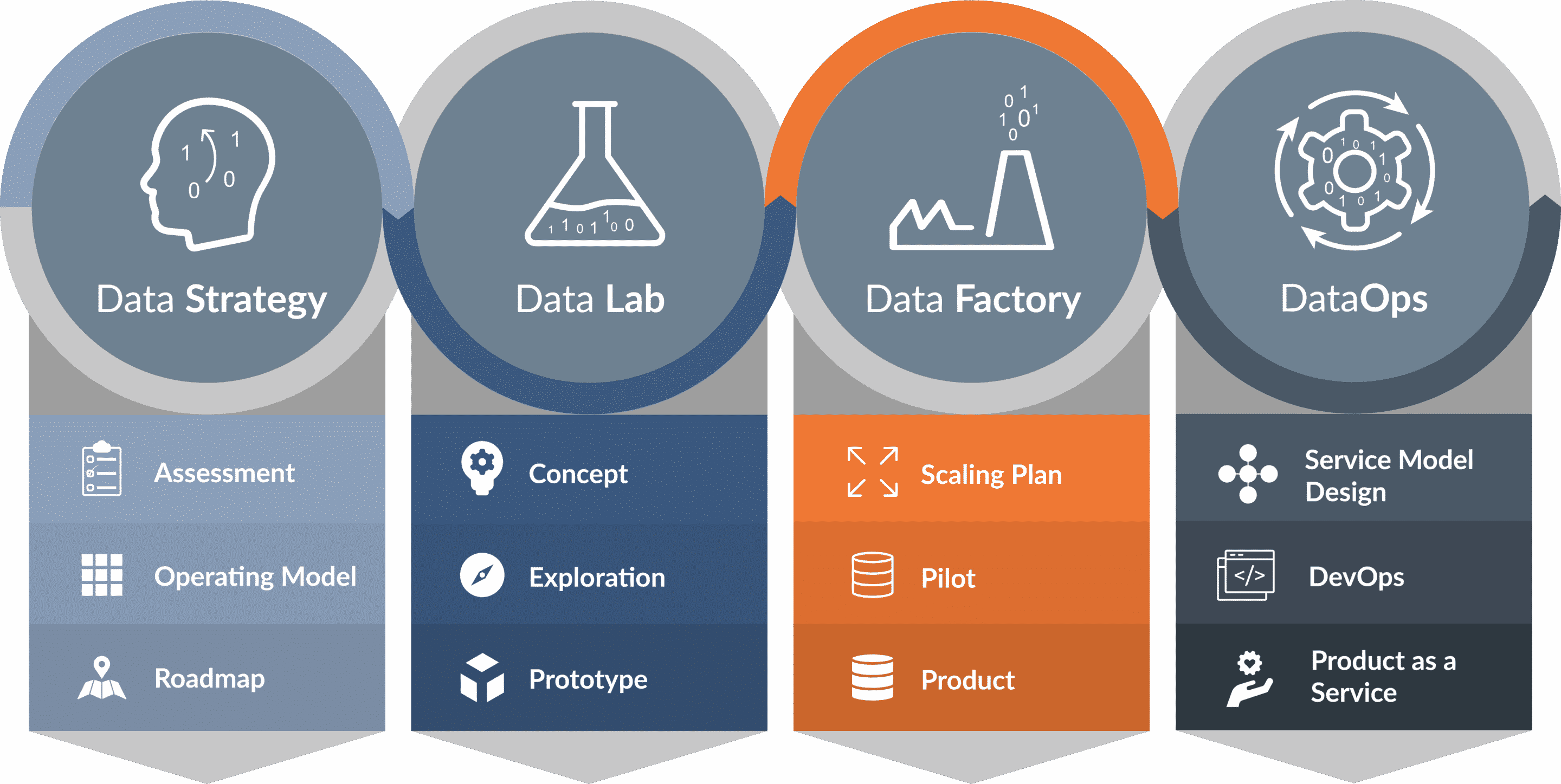

That is why we have developed the Data Journey, which is more than just data science consulting. A consistent data strategy forms the basis and the framework for generating real added value from data. The goal is to test use cases as quickly as possible - from concept to prototype with real data. In our Data Factory, use cases are industrialised into finished products or services. In our DataOps, we operate and maintain your platforms and machine learning algorithms.

Projects of our customers

The Data & AI experts at Alexander Thamm have already successfully implemented over 100 projects in the finance and insurance industry.

Automatic damage detection

- Claims settlement reduced from 9 months to 10 days

- 75 % less appraisal costs

- Cost savings in the millions with simultaneous increase in customer satisfaction

Automated immediate settlement for small claims with NLP

- Identification of data points to enable the automatic settlement of small claims

- Future reduction of the regulation time from several days to a few minutes

- Know-how transfer for the application of machine learning methods to the customer

Risk assessment of organisations through NLP and text mining

- Unstructured data from expert reports are made evaluable

- Faster and more efficient risk assessment

- The "risk" of a company becomes quantitatively measurable

Application for insurance tariffs

- Reduction of risk questions by 78%

- Great simplification of the application process

- Automated assessment of 1,300 features from external providers

Data analytics training concept for insurance companies

- Employees have a good understanding of data analytics and data-driven use cases

- The four modules that have been developed are independently feasible and recyclable

- Conduct training in 5 countries

Roadmap workshop in the insurance industry

- Generation and prioritisation of almost 90 use case ideas by the 25 workshop participants

- Elaboration of the top 3 use cases in detail

- Development of an extensive use case library incl. evaluation according to benefit and feasibility

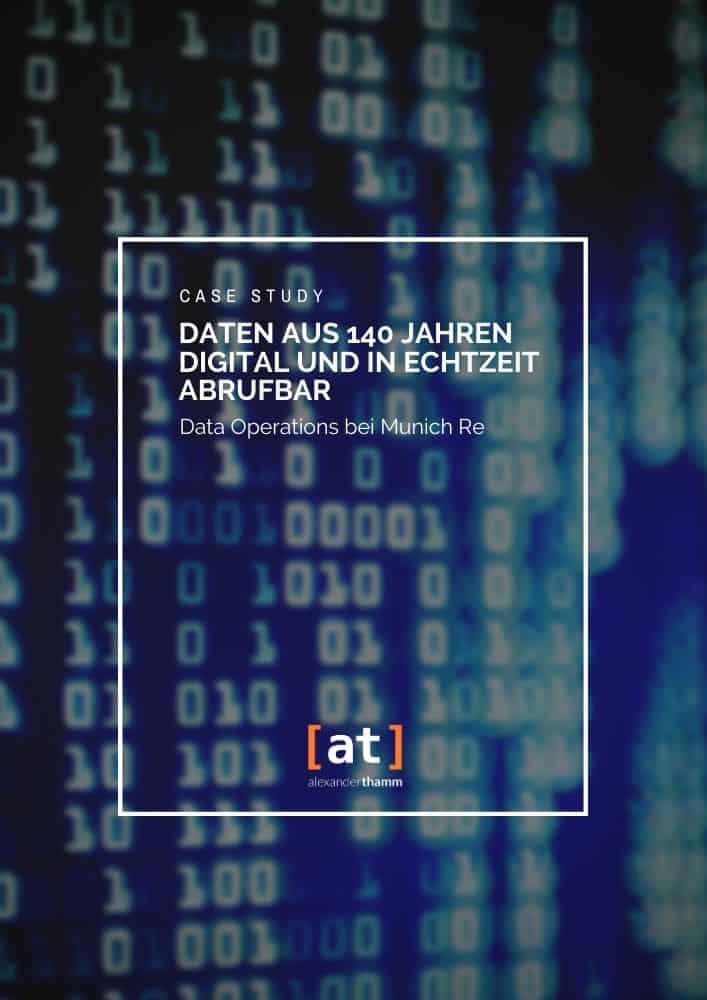

The MunicH Re case study

Munich Re is one of the world's leading reinsurers. Hardly any other company has more risk information at its disposal than the Munich-based company. In order to collect this knowledge in one central place and enrich it with further data, Munich Re developed a Data Lake. In cooperation with the data science and AI consultancy Alexander Thamm GmbH, internal and external systems were connected via data pipelines.

Find out more in our free case study.

Areas of application of AI in insurance

Efficiency increase

Make your business processes digitally more efficient

Compliance with laws

Ease of compliance thanks to AI

Customer Experience

Offer your customers a perfect user experience

Cost savings

Reduce resources through process automation

Development of new business models

Identify new potential with Data Science

Expanding and securing market share

Create significant competitive advantages with AI

Project examples for the use of AI in insurance

Simplified underwriting

with predictive analytics

A time-consuming and correspondingly cost-intensive task when taking out an insurance policy is the precise risk assessment. This requires very detailed information, which until now has had to be collected using extensive questionnaires. This process is often not yet carried out digitally.

To here to proceed more efficientlyit is worthwhile to categorise customers. In the future, low-risk clients will be treated with predictive Algorithms identified using extensive profile and behavioural data. These customers can thus be offered a simplified process for risk assessment. This measure improves both the customer experience and internal processes.

Customer Clustering

for the optimal customer approach

For a targeted and optimised customer approach, all relevant customer groups must be identified. Determining the criteria for meaningful customer segmentation for sales and marketing purposes is often difficult.

In this case, so-called "unsupervised machine learning" techniques are used.

Here an algorithm recognises Similarities in large data setswithout being given specific target values from outside, as is the case with demand forecasting. For this purpose, a combination of inventory data and external data is used in which commonalities are to be recognised and grouped (clustering). The results of this process lead to a customer segmentation that can be used to optimally address the respective customer group.

Second Medical Opinion

Various studies conclude that on average 15 % - 20 % of all diagnoses are wrong. With AI, these Misdiagnoses reduced in future become. Intelligent algorithms can compare many millions of cases in a few minutes or include image and text databases with existing diagnoses.

Patients are thus given the opportunity to obtain a second opinion with little effort. Second medical opinion means enormous savings potential for insurance companies. Not only can the number of incorrect treatments be reduced through the use of artificial intelligence in insurance, but the associated legal disputes and claims for damages are also drastically reduced.

Smart Home Concepts

for property insurance

Through smart homes in combination with KI opens up entirely new possibilities for property insurers - for example, home monitoring services can be bundled with residential building insurance. Intelligent algorithms can detect unusual events by identifying anomalies in sensor data that deviate from regular patterns.

In addition, insurance companies can offer their customers a mobile app that informs the customer about the risk of damage - such as from certain weather events or a cooker that has been switched on. IndividualSupplementary insurances can be offered within this framework and the first communication in the event of a claim can be made directly via the app.

Why with [at]

Leader for AI and Big Data

Technology-independent consulting

Insurance expert

We have successfully completed over 1,000 AI & Data Science projects, including over 50 in Finance & Insurance.

Creating real added value from data with [at]

With the help of data and artificial intelligence, we enable our clients to constantly change and adapt in the digital age.We empower our clients to develop their own strengths and accompany them on their journey with our [at] Data Journey.

The potential uses of artificial intelligence in banks are huge and offer incredible potential. Through our years of experience in the financial industry and the banking sector, we support you in identifying and implementing the right use cases to generate real added value from your data and develop new business models for your business.

Get advice without obligation

Simon Decker

Data & AI Projects Insurance & Finance

Your request

Current webinars from the insurance sector

In our Industry Exchange we talk about current topics from the insurance sector.