Artificial intelligence in banks

Big data and artificial intelligence are transforming banks in all areas - from robo advisors and fraud detection to chatbots in customer service and churn prediction.Learn about best practices and experiences and start your own data journey with [at].

Data & AI projects for banks

AI technologies make banking processes faster, money transfers safer and back-end operations more efficient. Banks can use AI to transform the customer experience by Smooth customer interactions 24/7 on different channels. However, AI banking applications are not limited to banking services for private customers. Business customers, investment banking and all other financial services could also benefit from AI.

Through the use of artificial intelligence, enormous increases in efficiency and yield can be realised in all areas.

Through the use of chatbots and robo-advisors, it is possible to Resources saved and costs reduced become. Customer loyalty can be strengthened through personalised offers and additional functions based on the evaluation of customer data. Entirely new target groups can be tapped through the development of new, data-driven products. By linking a wide range of internal and external data and using intelligent algorithms, for example, micro-loans can be granted in real time directly via the smartphone.

Projects of our customers

The Data & AI experts at Alexander Thamm have already successfully implemented over 1,000 projects - including over 100 projects in the finance industry.

Fraud detection with network analyses

- Cases of fraud are detected earlier or can even be prevented

- Novel visualisation tool for the detection of hubs and product relationships

- Customer & transaction relationships are better identified

Credit scoring

- Reduction of defaulted loans by over 90 %

- Determination of concrete probabilities of default for each customer

- More flexible lending

Community Score

- Evaluation of individual user activity in the community

- Scores offer users an incentive

- General overview of the activity in the community

Customer Lifetime Value

- More precise calculation of the customer lifetime value

- Sankey diagram as part of an interactive dashboard for better visualisation of the customer history

- Interactive visualisation of the customer journey

Implementation of an overdraft scoring model

- Implementation of a Random Regression Forest in Spark and H20 (Sparkling Water)

- Automated retraining of the model with current data possible

- Fulfilment of all risk management requirements

Fraud prevention for vehicle financing

- Reduction in the number of salary slips to be checked manually by 56 %

- Consistent fraud detection rate

- Optimisation of internal processes

Download Whitepaper

Artificial Intelligence in Banks: Getting Started | Areas of Application | Use Cases

Areas of application of AI & Big Data in banks

The use of data science and artificial intelligence is already having a massive impact on the banking sector. Banks have large amounts of data that offer huge potential. In the following, we present some fields in which artificial intelligence can be used in banks and companies:

Fraud detection

Detect and successfully combat fraud attempts in real time.

Predictive banking

Enable customers to have transparency and predictability over their own finances through analytics and data-driven banking.

Robo-advisors

Development of new customer segments through automated recommendation and management of investments.

Credit scoring

Reduce default risks with AI-supported credit scoring tools and make credit decisions extremely quickly and sometimes even in real time.

Chatbots

Relieve and optimise customer service and back office by using virtual assistants and digital robots in customer communication.

Churn Prediction

Identify customers at risk of churn and retain them through targeted approaches and offers.

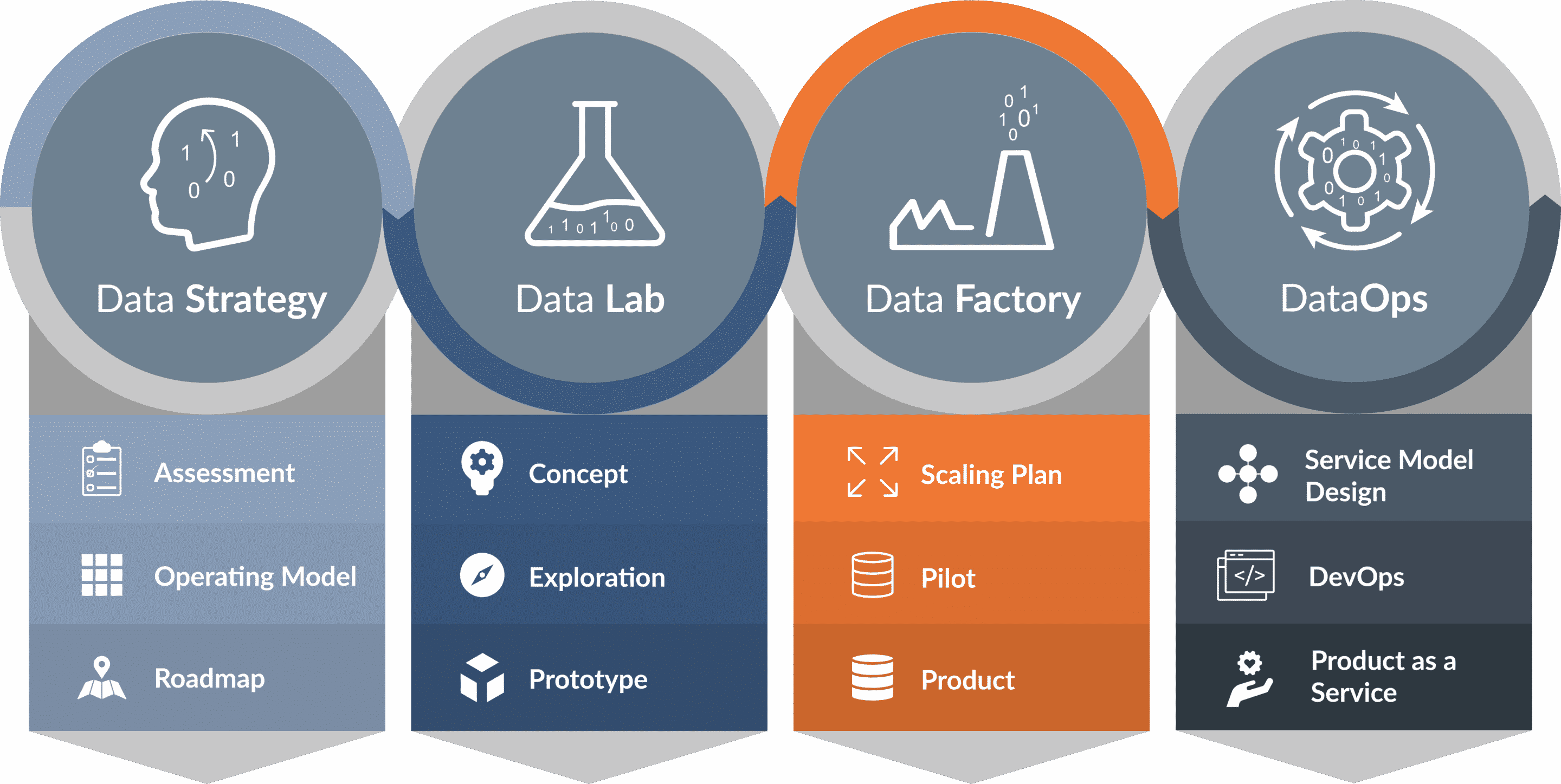

Creating real added value from data with [at]

With the help of data and artificial intelligence, we enable our clients to constantly change and adapt in the digital age.We empower our clients to develop their own strengths and accompany them on their journey with our [at] Data Journey.

The potential uses of artificial intelligence in banks are huge and offer incredible potential. Through our years of experience in the financial industry and the banking sector, we support you in identifying and implementing the right use cases to generate real added value from your data and develop new business models for your business.

Artificial intelligence in banks - a few facts

A study by htw saar reveals interesting figures about data science & artificial intelligence in banks.

%

of banking institutions use AI applications in regular operations.

%

of banks do not implement sufficient AI governance.

%

of all banks surveyed have a defined and fully implemented AI strategy.

Do you still have questions?

Simon Decker

Data & AI Projects Insurance & Finance